- Fucked Finance

- Posts

- Stock Tip Tuesday

Stock Tip Tuesday

The next critical metals multi-bagger?

Stock Tip Tuesday…

Alright, fellas, it’s Tuesday, so here’s your stock tip.

NEWS

$TMGLF Americas Critical Metals Saving Grace?

Disseminated on Behalf of Trigg Minerals LTD

If you’ve been paying any attention to the markets, Trump has basically been spelling out which sectors he wants money flowing into. The guy talks loud, and if you’re smart, you listen. When it comes to investing where government policy aligns, US critical metals should be the first stop.

Out of the updated 60 critical minerals list, antimony and tungsten are right at the front.

These two metals are the backbone of defense and tech. They keep the country running, yet China controls the supply. You can guess how well that sits with Donny. He wants domestic control, and he wants it fast. That shift puts homegrown critical mineral names in the spotlight, which brings us to Trigg Minerals (OTCQB: TMGLF).

Trigg Minerals isn’t just another mining story collecting dust in your portfolio. This is America’s shot at critical metals independence, and they’re positioning to become the first significant domestic antimony producer in decades. $TMGLF controls one of the highest grade antimony deposits in the United States and has assembled a world class antimony mining team to push a full mine to smelter plan forward. The company is already deep into securing a site for its US based smelter.

And they aren’t just cooking with antimony. They also hold one of the most prolific tungsten portfolios in the country. That combination makes them look like pocket aces to Uncle Sam.

Why Antimony and Tungsten Are Trump’s Strategic Priorities

What is antimony used for in Trump’s defense buildup? Everything that matters. Antimony is essential for over 80,000 parts across 1,900 weapon systems. Every night vision goggle, every armor piercing round, every flame retardant system relies on antimony in some form. As Trump ramps up defense spending with that new $150 billion mandatory Pentagon funding stream, antimony demand is about to go ballistic.

Tungsten is the other half of the equation. It has the highest melting point of any metal and is irreplaceable for precision guided munitions, jet engines, and armor piercing projectiles. Trump’s modernization programs are consuming more tungsten than ever, while China controls 80.7% of global production.

The shortage is pushing Trump’s domestic production push harder than anything else. Antimony sits at the top of his list because China controls 53% of global supply and the US has had zero domestic production since the mid 1990s. With trumps ambitions for AI and Defense and the tensions between US and China, this is nothing short of a national emergency.

Trump’s semiconductor push makes this even stronger. The CHIPS Act and his reshoring plans require large amounts of both metals. Every advanced chip, every precision part, and every defense system needs them. When Trump talks about bringing semiconductor manufacturing back to America, he’s talking about securing the critical minerals behind it.

Trigg Minerals $TMGLF: Perfectly Positioned for Trump’s America First Strategy

$TMGLF has quietly built one of the most compelling dual critical mineral portfolios in North America. Their flagship Antimony Canyon Project in Utah holds the largest and highest grade antimony deposit in the United States, with peak assays hitting 33% percent antimony.

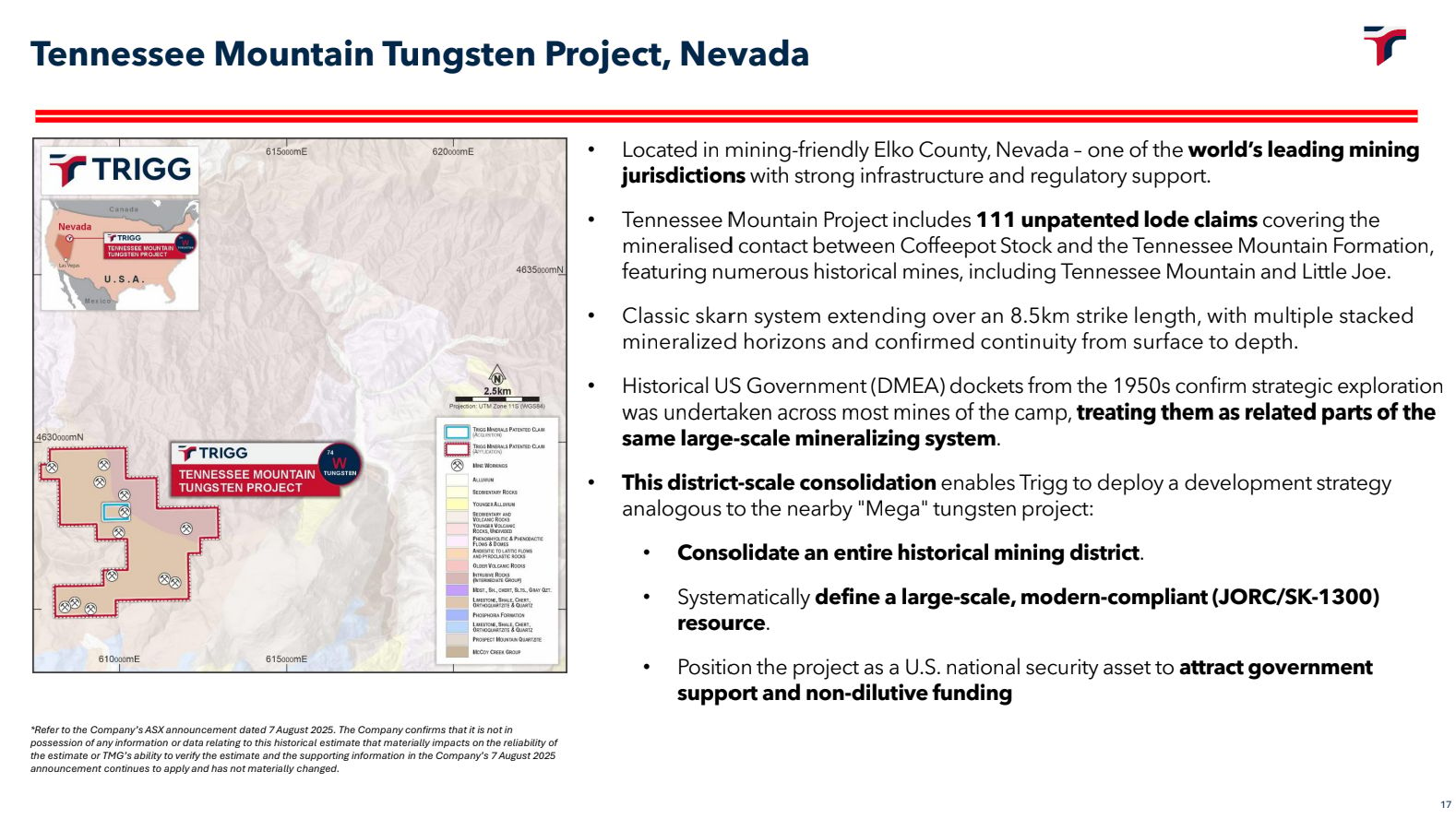

But here’s where shit gets really interesting. While everyone is focused on the antimony story, Trigg has been building one of the strongest tungsten portfolios in the country. The Tennessee Mountain Tungsten Project in Nevada, plus acquisitions in the historic Nightingale District, give Trigg control of a 3 mile mineralized trend with grades from 0.7 to 0.9 percent, roughly double the global average of 0.3 to 0.5 percent. These are some of the strongest tungsten intercepts in the US.

The setup is so strong that Trigg was invited to brief the Utah State Legislature on the national security importance of its antimony and tungsten assets. That invite wasn’t random. It signals one thing: state and federal decision makers see $TMGLF as a future backbone of America’s critical minerals supply chain.

Trigg isn’t planning to dig holes and ship ore to China. They are building a full mine to smelter operation on US soil. They have the only team outside of China that has actually built and operated a modern antimony smelter. $TMGLF is set to become the United States’ first modern antimony producer.

The strategic positioning becomes even more compelling when you consider Trump’s government support. The U.S. has classified both antimony and tungsten as critical minerals, which means domestic producers can access expedited permitting, financial incentives, and strategic stockpile purchases. When the Pentagon starts buying your product and the government fast-tracks your permits, that’s exactly the kind of setup that creates massive returns.

The Defense, Semiconductor, and Project Genesis Spending Explosion

Trump’s defense plans are creating uncontrollable demand for antimony and tungsten. The new $150 billion Pentagon funding stream is putting pressure on supply chains and forcing the US to rebuild domestic production.

But then Trump JUST launched Project Genesis, the national mission designed to accelerate America’s AI, semiconductor, advanced computing, and defense technology infrastructure. The Genesis Mission will connect America’s top supercomputers, AI systems, experimental facilities, and major technical datasets to double US research output within a decade.

And here’s the part most investors are still sleeping on: Project Genesis cannot be built without domestic antimony and tungsten: The chips, sensors, electronic systems, hardware lines, and defense platforms it demands all rely on these minerals.

Critical minerals have now moved to the top of Trump’s agenda because the US cannot grow its AI and defense capability while relying on foreign supply chains dominated by China.

$TMGLF sits directly in front of this shift.

They control one of America’s highest grade antimony assets and are advancing a mine to smelter operation meant specifically to supply US demand. That makes $TMGLF a direct player in the Project Genesis supply chain.

The semiconductor angle multiplies the setup. Every fab plant, advanced chip, and next generation weapons platform needs antimony and tungsten. As the US reshapes the semiconductor supply chain under the CHIPS Act and Project Genesis, demand for these minerals is set to surge.

Mining investments aligned with this policy direction are finally starting to get attention. Retail and institutional money are waking up. We are still early. This is just the start.

The combination of defense spending, semiconductor growth, and the national AI infrastructure plan creates long term, unavoidable demand for these minerals. That demand stretches far into the future, and right now there is a window for generational wealth as the mineral supercycle begins.

Nobody stands to benefit more than the companies making this shift possible, which is why $TMGLF sits at the top of our watch list.

Investment Catalysts Aligned with Trump Policies

Trigg Minerals is approaching several catalysts that match Trump’s priorities. The company is progressing through feasibility and permitting steps that could unlock major value as each milestone removes execution risk.

The broader critical minerals theme is gaining momentum as institutions start to understand the supply chain threat. With China tightening export controls and US demand growing across defense and semiconductors, companies like Trigg with advanced assets are moving toward premium valuations.

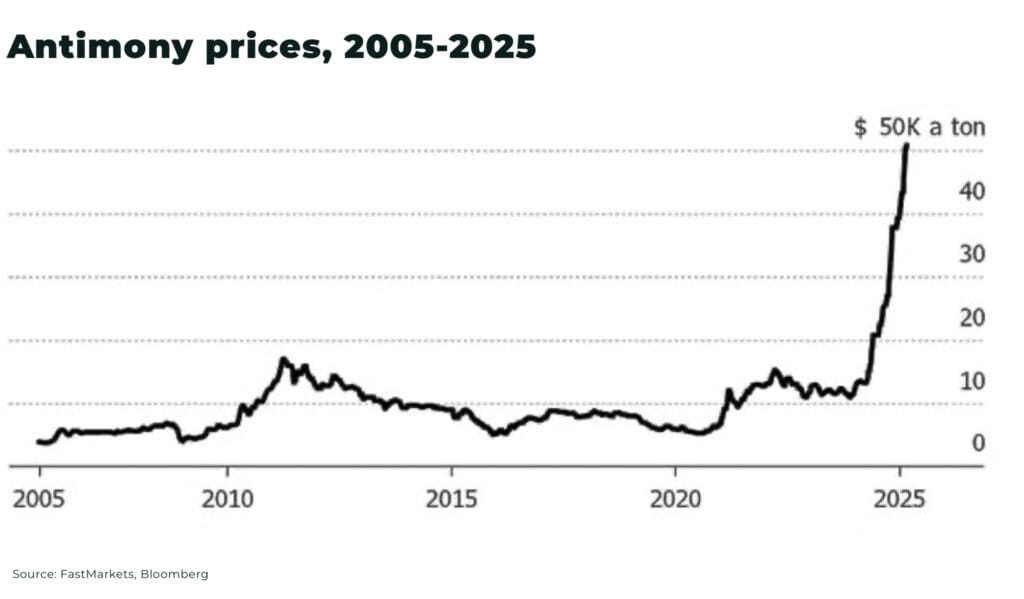

Market dynamics are shaping up fast for domestic producers. US antimony pricing of $55,000 to $60,000 per ton versus Chinese pricing creates strong margin potential for producers who avoid geopolitical risk. Tungsten pricing offers even higher premiums for secure US supply.

The Bottom Line: The Perfect Trump Trade

Trigg Minerals checks every box in this new policy-driven market. Trump’s defense push, AI infrastructure buildout, and the urgent need for domestic antimony and tungsten supply all point toward a major rerating for the first company able to deliver.

This type of setup doesn’t last. When Washington prioritizes a resource, and only one company is positioned to fill the gap, the early entry window closes quickly.

There’s also a catalyst most investors don’t know about yet. The company plans to rebrand as American Tungsten and Antimony, aligning directly with the U.S. identity and national-security narrative driving this entire cycle.

Getting in before the rebrand could be the difference between entering early and chasing later. If this story catches wider market attention after the name change, the upside window could move fast.

Click below to read why Zero Hedge thinks $TMGLF is set to break-out

Thank you

That’s All Folks

Thank you for reading. Like usual. Not financial advice.

We own stock in Trigg Minerals. Full disclaimer here

Cheers,

Legal

Disclaimer

Black Swan Solutions Inc., doing business as VHLA Media (“Black Swan”) is not a registered investment advisor, broker-dealer, analyst, or financial professional in any jurisdiction. All information contained in this publication has been obtained from publicly available sources, regulatory filings, company statements, presentations, or information provided directly by Trigg Minerals Limited. Black Swan does not warrant or guarantee the accuracy or completeness of such information and provides it on an “as is” basis. Readers must verify all facts independently and conduct their own due diligence.

The compensation received by Black Swan covers production and distribution of marketing materials across digital platforms, newsletters, sponsored articles, paid advertisements, websites, blogs, social media, Discord channels, Telegram groups, and other online outlets.

Black Swan Solutions Inc., doing business as VHLA Media (“Black Swan”), has been paid CAD $175,000 by Trigg Minerals Limited for a marketing, media, and awareness campaign. This communication is a paid commercial advertisement intended solely for informational and promotional purposes. It does not constitute financial advice, investment advice, an offer to buy or sell securities, or a solicitation to purchase or trade any security.

Black Swan Solutions Inc., or its affiliates, including entities under common ownership, currently hold shares in Trigg Minerals Limited. Additionally, directors, officers, employees, or affiliates of Black Swan may buy or sell securities of Trigg Minerals Limited at any time without notice. This material is for informational purposes only and does not constitute investment advice.

This publication may include forward-looking statements that involve substantial risks and uncertainties. These statements reflect current expectations but are subject to factors that may cause actual results to differ materially, including operational challenges, regulatory developments, market volatility, financing risks, geopolitical events, commodity price fluctuations, and other uncertainties. Neither Trigg Minerals Limited nor Black Swan undertakes any obligation to update or revise forward-looking statements.

Investing in micro-cap, small-cap, OTC-listed, and ASX-listed securities involves a high degree of risk. These securities may be extremely volatile, illiquid, and speculative. There is a real possibility of losing all or a significant portion of invested capital. Readers should consult a licensed financial advisor who is familiar with their individual financial situation and risk tolerance before making any investment decisions.