- Fucked Finance

- Posts

- Stock Tip Tuesday

Stock Tip Tuesday

All Aboard The Copper Train

Stock Tip Tuesday…

The Copper Squeeze is here, we said it.

NEWS

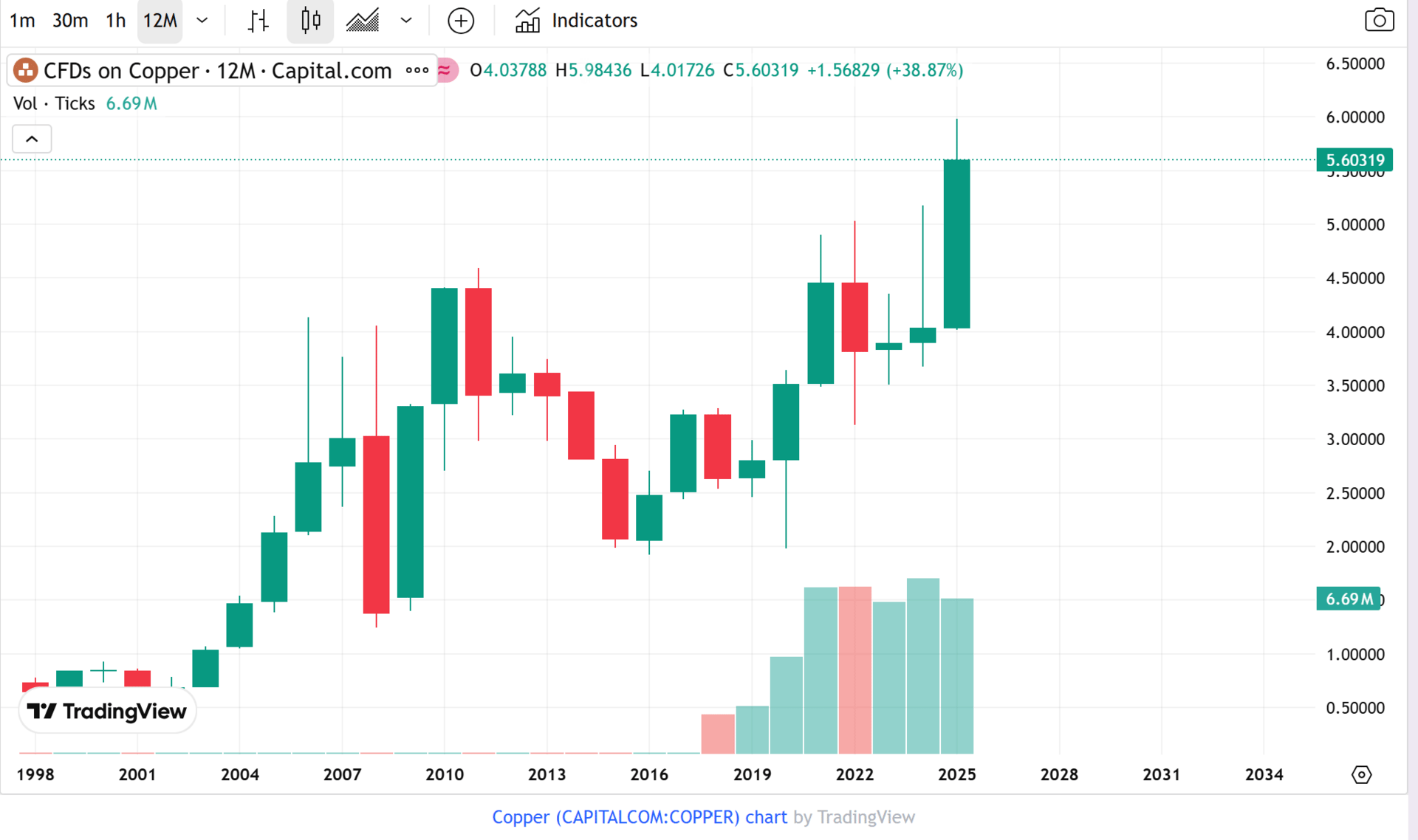

COPPER IS CRUSHING ALL TIME HIGHS

The Copper Squeeze is here, we said it.

Copper just printed fresh record highs. 2025 is now tracking toward its strongest annual move since 2009.

That is what happens when supply stays tight as a nun, while demand keeps compounding from electrification, AI data centers, grid upgrades, and energy storage.

The copper squeeze isn’t a meme, it is here.

Super Copper Breakthrough: A Real Chilean Milestone

While most eyes stay glued to mega-cap copper names, Super Copper Corp. is lowkey mogging.

Chile’s National Mining Authority Super Copper’s Cordillera Cobre Project, covering approximately 6,858 hectares in the Atacama copper belt. These are exploitation concessions, not early-stage claims, which grant the rights to:

Drill and build drill platforms;

Conduct advanced exploration;

Develop economic studies;

Construct mining operations;

Produce and sell copper and resources from the property.

In Chile, that distinction matters because it removes risk.

WHAT INVESTORS HAVEN’T SEEN YET, AND WHAT’S COMING NEXT

This is the part the market hasn’t priced in, because the data simply hasn’t been released yet.

Over the past several months, Super Copper has been running multiple parallel work programs across its core properties, all of which are now complete and awaiting disclosure:

Induced Polarization (IP) surveys to identify potential copper targets at depth

Magnetic surveys to map structures and alteration trends

Re-logging and assaying of historical drill core, modernized to current standards

Surface sampling and trenching programs designed to validate and extend known copper mineralization

These programs collectively represent the first integrated technical dataset investors will see across Super Copper’s project portfolio.

Importantly, this isn’t conceptual work anymore. Samples are at the lab. Core has been logged. Geophysics is processed. According to the company, results are expected to be announced soon.

For early-stage copper explorers, this is often the inflection point where the rocks do the talking…

THE MACRO BACKDROP JUST GOT LOUDER

Chile also just elected president-elect José Antonio Kast, a pro-market conservative figure that global investors are already framing as more mining- and business-friendly.

In the world’s largest copper-producing country, this shit matters, especially when capital allocation decisions are being made years in advance.

THE SETUP

If you want large, liquid, established copper exposure, the market already knows where to look:

Freeport-McMoRan

Southern Copper

Teck Resources

First Quantum Minerals

Or… if you’re like us and looking for high-risk, asymmetric upside, the kind that moves on a catalyst rather than copper prices alone, Super Copper (CSE: CUPR | OTCQB: CUPPF) is where we have our chips.

In our opinion now’s a better time than ever to take a look, as we are on the brink of the first real glimpse of what the company is sitting on beneath surface headlines.

Thank you

That’s All Folks

Thank you for reading. Like usual:

Not financial advice. This content is provided for general information and entertainment purposes only and should not be relied on as investment, legal, or tax advice. We are not registered financial advisors, brokers, or dealers. We did not receive any compensation, cash or otherwise, from the company mentioned or from any third party for this content. We currently own shares of the securities discussed, and we may buy or sell securities at any time without notice. Any opinions expressed are based on publicly available information and personal views at the time of writing and may change without notice. Investing in public markets involves risk, including the possible loss of capital. You are solely responsible for your own investment decisions. Always conduct your own independent research and consult a qualified professional before making any investment decisions.

Full disclaimer here

Cheers,